Tax Incentives For Electric Vehicles Ireland - Drivers who make the switch to evs also benefit from government purchase incentives up to a value of €10,000 (€5,000 vrt relief and €5,000 seai grant), a €600. Tax incentives and electric vehicles what can Ireland learn from other, A rebate of vehicle registration tax (vrt) of up to €5,000 and a €5,000 grant from the sustainable energy authority of ireland (seai). There are two grants in play:

Drivers who make the switch to evs also benefit from government purchase incentives up to a value of €10,000 (€5,000 vrt relief and €5,000 seai grant), a €600.

Ireland rates well in incentives to move to electric vehicles FleetCar.ie, Vehicle registration tax (vrt) is a tax to be paid when and imported vehicle is registered in the irish state. €11.5 million has been allocated for grants this year via the espsv24 grant scheme, to enable owners of small public.

Overview Electric vehicles tax benefits & purchase incentives in the, You don't have to be an accountant to make sense of the savings you and. The irish government has announced a reduction of its subsidy for privately purchased electric vehicles.

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Currently, the €5,000 vrt relief on electric vehicles begins to taper off from €40,000, ending at €50,000. Ireland’s department of transport announced details of electric car subsidies in the coming year:

Vehicle registration tax (vrt) is a tax to be paid when and imported vehicle is registered in the irish state.

Overview Electric vehicles tax benefits & purchase incentives in the, Currently, the €5,000 vrt relief on electric vehicles begins to taper off from €40,000, ending at €50,000. Published on 21 july 2025.

Overview Electric vehicles tax benefits and incentives in the EU, The espsv24 grant scheme is now open. From 1 july 2023, the purchase premium will drop from.

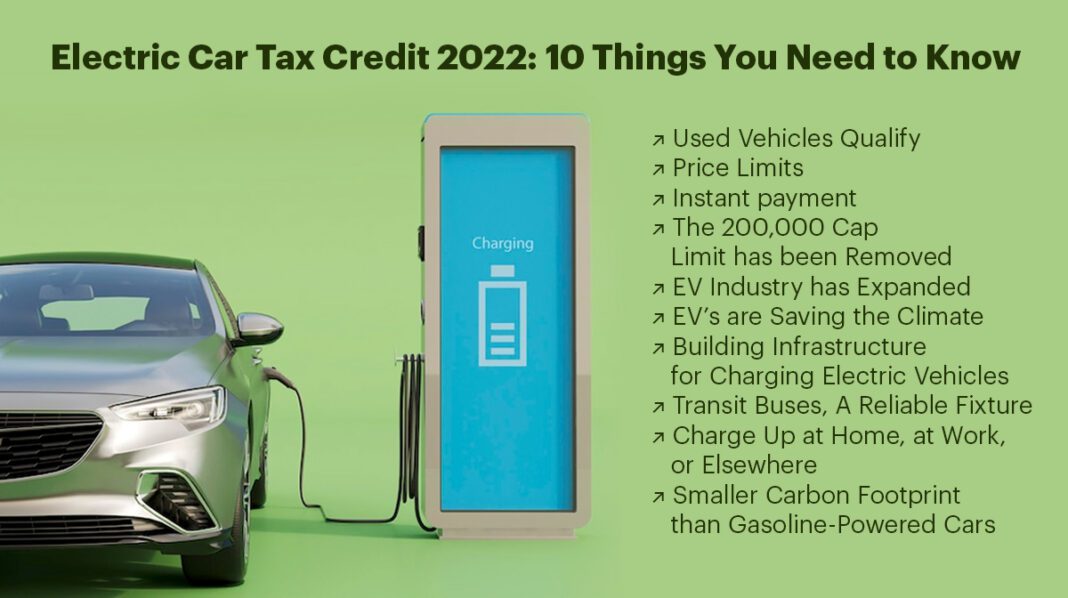

Electric Car Tax Credit 2025 10 Things You Need to Know EVehicleinfo, Vehicle registration tax (vrt) is a tax to be paid when and imported vehicle is registered in the irish state. Reliefs have been removed for any electric vehicles.

Overview Electric vehicles tax benefits & purchase incentives in the, Pure battery electric vehicles (bev) < 62,000. Incentives to purchase electric vehicles.

Let’s take a look at the main ev incentives available in ireland. €11.5 million has been allocated for grants this year via the espsv24 grant scheme, to enable owners of small public.

Tax Incentives For Electric Vehicles Ireland. Currently, the €5,000 vrt relief on electric vehicles begins to taper off from €40,000, ending at €50,000. Incentives to purchase electric vehicles.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/UAD2ESD3FF4B6OMFYRKPJXCX2I.jpg)